Audience

Built for every role ina private markets.

Family Offices

We’ve built workflows tailored to how family offices operate — managing deal flow, creating memos, conducting research, benchmarking opportunities, and tracking introductions. Nvestiv gives small teams the scale and leverage of a fully staffed investment operation.

Asset Managers

Raising capital demands speed, clarity, and precision. Nvestiv creates AI agents that help fund managers identify LPs, run targeted outreach, manage follow-ups, prepare materials, and close raises faster with less friction.

Institutions

Institutions run complex, high-volume workflows across research, investment, IR, and operations. Nvestiv keeps every relationship, opportunity, document, and update aligned, giving teams a single, coordinated intelligence layer that reduces complexity across the entire organization.

Service Providers

Advisors, lawyers, accountants, consultants, and intermediaries win by delivering insight and responsiveness. Nvestiv helps service providers understand client needs, track every interaction, surface opportunities, coordinate introductions, and deliver higher-value support — without the operational overhead.

Wealth Managers

Modern wealth management goes beyond portfolios. Nvestiv helps advisors track client interests, surface private investment opportunities, coordinate introductions, and stay proactive — delivering a more informed, differentiated client experience.

Startups

Founders spend too much time chasing investors and managing chaos. Nvestiv helps startups identify aligned investors, organize outreach, track conversations, manage data rooms, and run a disciplined, professional capital-raising process from day one.

News Flash

CRMs Were Never Fine — We Just Pretended They Were

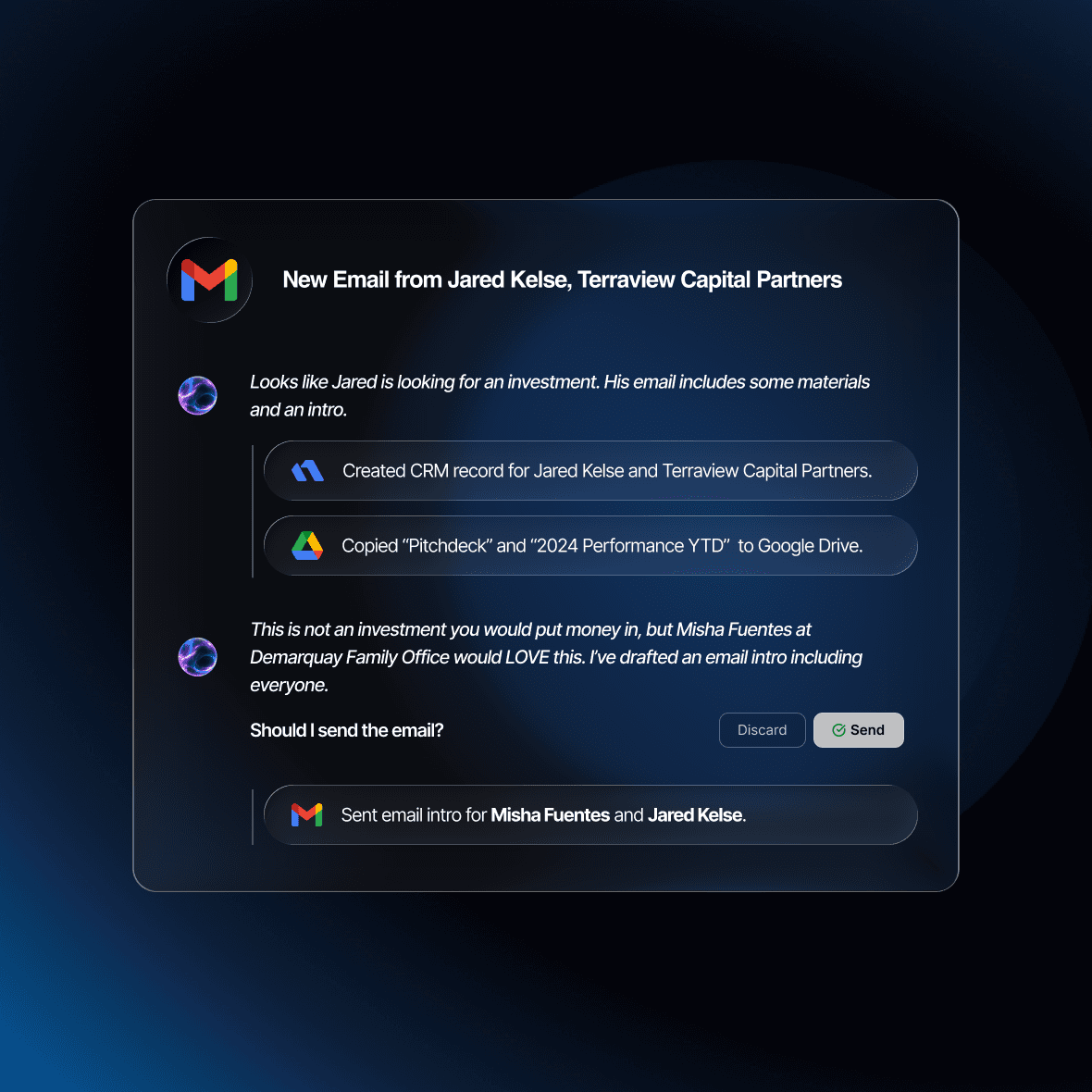

In private markets, everything lives across emails, files, calls, documents, and conversations — so generic CRMs never capture the real picture.

Nvestiv changes this by doing the work for you.

It reads your activity, understands who people are, what deals you’re discussing, and what’s happening — then updates itself automatically.

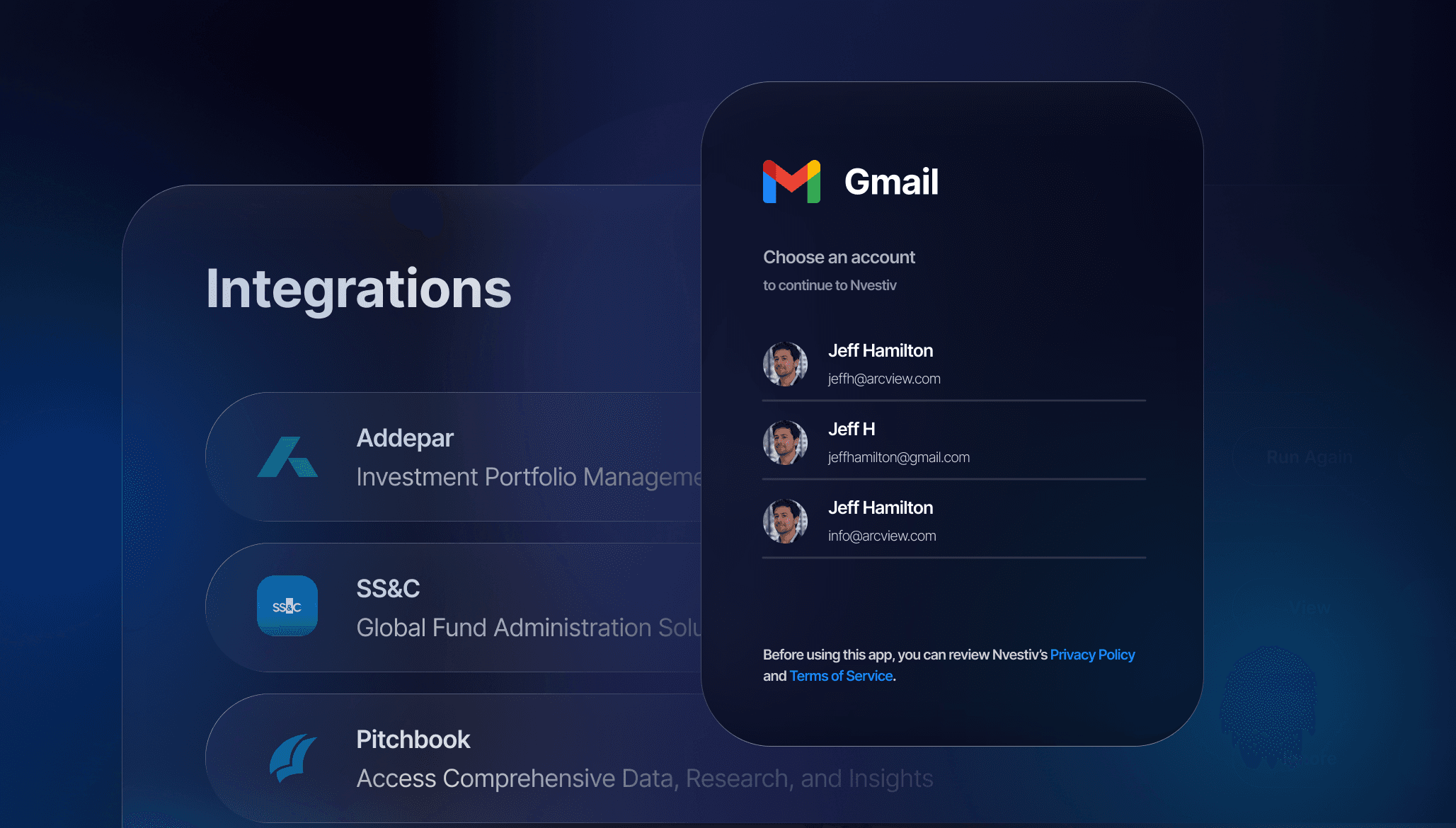

AI Native

Conversation is the new User Experience

Emails

Your CRM Builds Itself

Files

Your Files Now Help Make Decisions

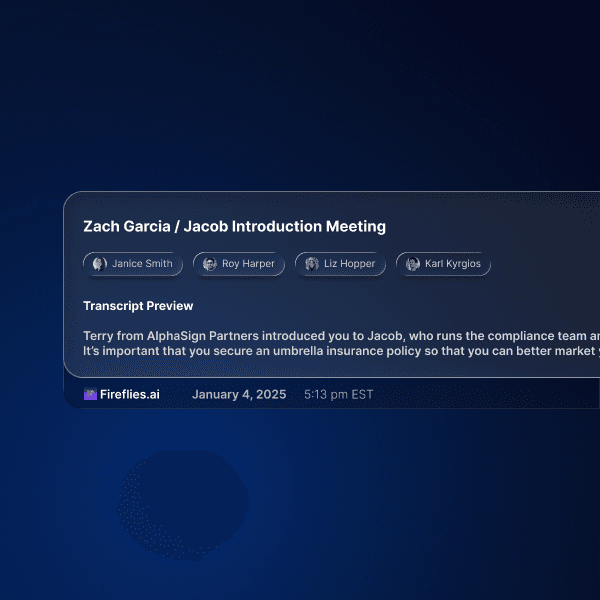

Meetings

Your Meetings Turn Into Structured Intelligence

Integrate your AI notetaker and IRIS transcribes, summarizes, extracts insights, and updates CRM records automatically — linking everything to the right contacts, deals, and firms.

Live Data

Imagine A CRM That Tracks Your Relationships

iris